Have you ever Googled a famous person to find out their net worth? I know I have. Do you know what it means? Do you know how it’s calculated? Most importantly do you know that you have one? In this week’s post, we are going to go over the basics of what a net worth is and why you should pay attention to it.

What’s a Net Worth?

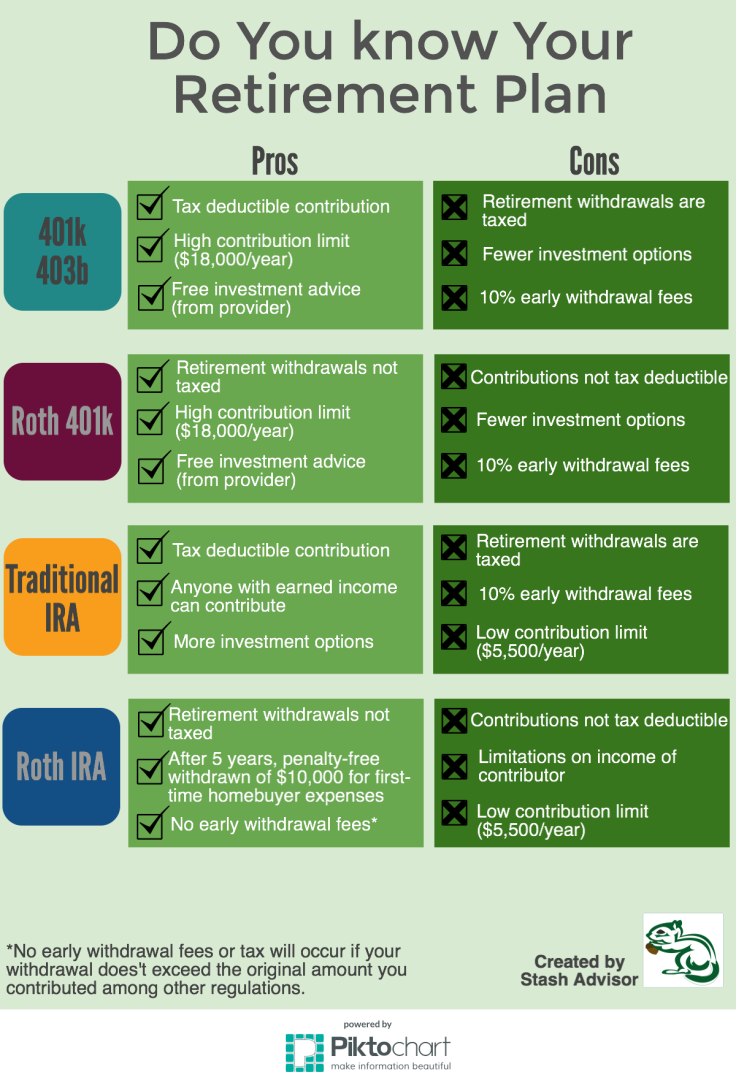

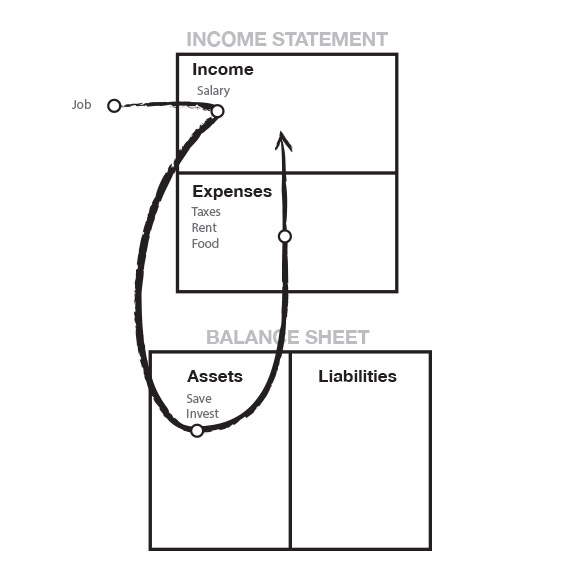

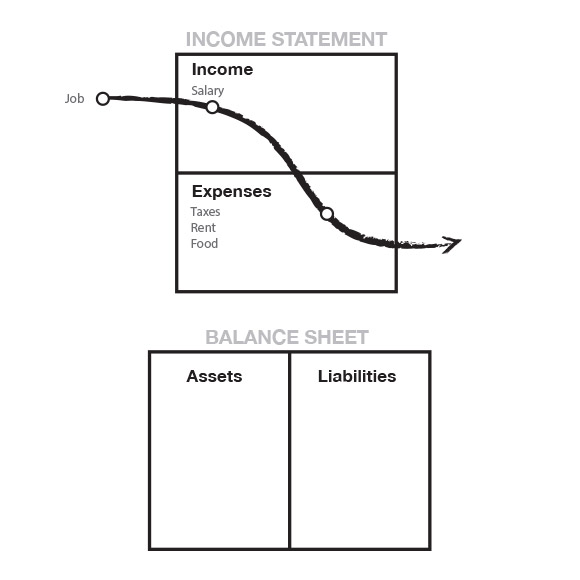

A net worth is essentially the sum of your assets subtract your liabilities. Assets being the things you own such as cars, cash, homes, investments, anything of substantial value. Then liabilities being the thing you owe to others,this can include credit card debt, your mortgage, student loans,etc.

How to Calculate Your Net Worth

Calculating your net worth is an easy process. All you have to do is add up all the assets you possess, then subtract the total sum of assets from your liabilities to get the final amount. For instance, imagine you own a house that’s worth $100,000. And a car that’s worth $40,000. Now imagine you have $30,000 dollars worth of student loans. To calculate your net worth you add the house and car amount together to get your total assets which is $140,000 and subtract the student loans debt of $30,000 which would make your net worth $110,000. Based on the results you may find that you have a positive net worth if you have little debt, and a negative net worth if you have a lot of debt. So, why is this important?

The Importance of Net Worth

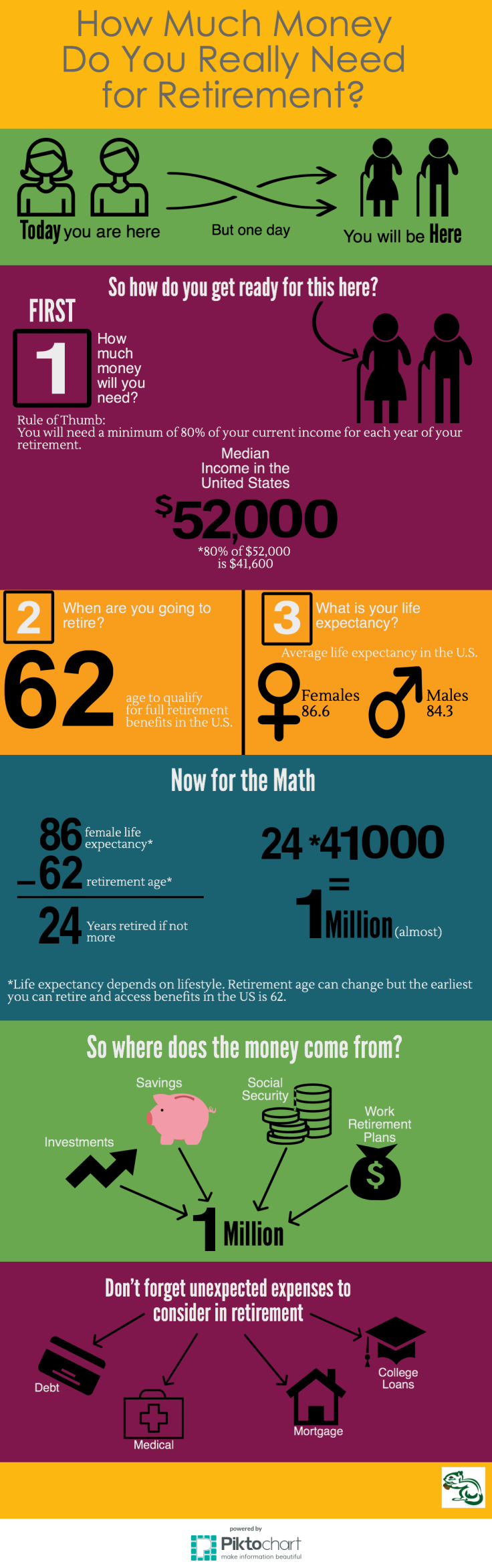

It’s good to check your net worth from time to time because it will let you know if you’re on track to achieving your financial goals. Think of checking your net worth like checking how much you weigh. When you check out how much you weigh you have an accurate idea of if your workout and diet plans are effective. likewise checking your net worth will let you know if you will have an effective financial plan and strategy for investments, savings, and retirement.

Increasing Your Net Worth

The simplest way to increase your net worth over time is to diminish your debt and increase your assets. There are many ways to do this. Methods include paying off your debts, reducing your spending, and increasing your savings, investments, or income. However, whichever strategy you use, make sure you stick to it and stay consistent.

Net worths are not just for the rich. Although it’s a simple calculation. It’s an invaluable tool to check in with yourself to see how you are doing financially. It will allow you to see if your strategy for accumulating wealth is working or if you need to reassess your financial plans. And who knows, if you check in with your net worth long enough and tweak your strategy, you may eventually find yourself among the very rich.