I’m always looking for ways to improve the way that I build my wealth. It often comes from reading new information, trying it out and taking notes to see if it adds to my strategy. It is often the strategy and habits you form that create your circumstance. That’s why this week I thought I would share with you some tips that I found to be interesting and useful.

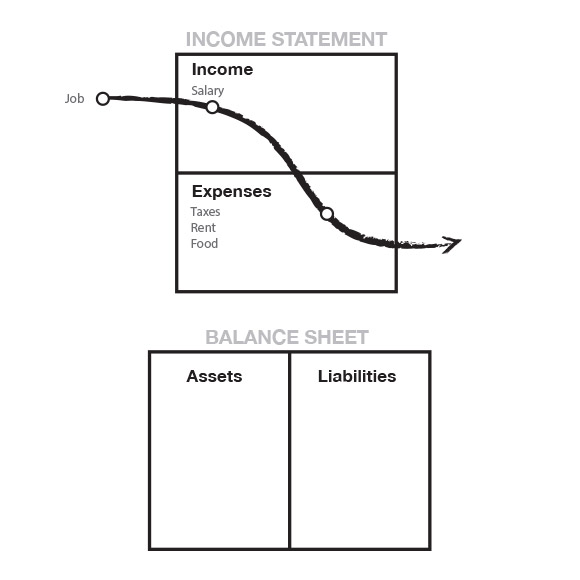

Keep Track of Your Spending

How many of you keep tabs on your spending? I know that I haven’t, until recently. Up until now I’ve thought that keeping a budget was enough to keep myself on track. However, tracking your spending on top of having a budget keeps you doubly honest. In addition to this you get to see any potential mistakes that were made. This may end up saving you a lot of money over a long period of time because nothing is slipping past you. In addition to this, you will also be able to detect any indications of fraud early on. Finally, tracking your spending is a great way to trim the fat off your spending. After going over your purchases, you may see some purchases that stand out as the thing you spend on the most. Cutting back or eliminating this cost may increase you income in the long run.

Set Short Term Financial Goals

You may have goals of how much money you want in the distant future, but do you have financial milestones for the short term? This practice can help keep you on track towards reaching your goals, give you an idea of what you need to do to get there, and let you know how well you’re holding to your goals. For example, you should have a goal of what you would like your net worth to be in the next six months to a year.

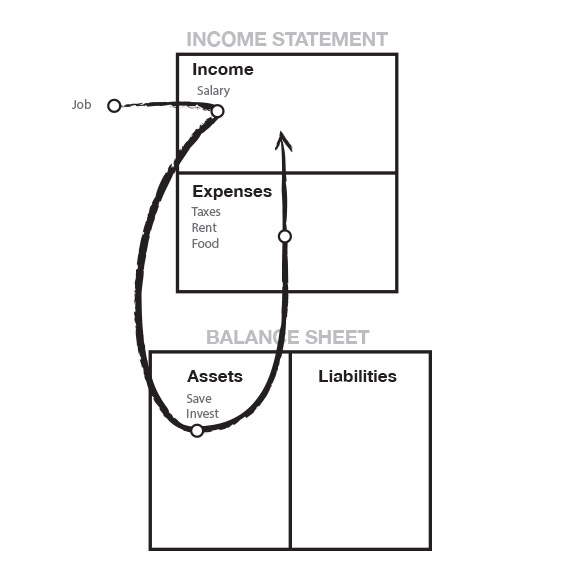

Save but Don’t Over Do it

Having an emergency savings fund is very important. However, there is a point where saving can be a detriment to increasing of your wealth. The goal of an emergency fund is to have enough money to be unemployed for six months, unless there is an extreme reason Also keep in mind the money you save should be in a high yielding interest account to keep up with inflation. After you have six months of savings, you should put that money into some form of investment to make your money grow rapidly.

Setup Calendar Alerts to Pay Bills on Time

In a previous blog, we’ve said that you should automate your finances to make your life much easier. However, I recognize that one may not be comfortable having to pay their credit card bill automatically. In addition to this, one may not be able to automate certain payments. That’s why another great alternative is setting calendar reminders. Setting a reminder a few days before you bills are due is a great way to keep on top of paying for things and not racking up late fees. You can also set up reminds for starting your taxes on time.

Wait a Day or Two Before Making a Purchase

Walking through the mall or through a store can invoke strong emotions that may cause you to want to spend. Often after a purchase you may have buyers remorse over something that you decidedly may not have needed as badly as you thought. To prevent this you can try waiting a day or two to make the purchase on the thing that you thought you wanted. Either the emotion of purchasing the item will wane or it will still be as strong as the first time you wanted to purchase it. Doing this will keep you from making unnecessary purchases. If you are concerned about the item not being there in a day, put it on hold.

These are a few little tips that I thought could make a big difference in the amount of money that you retain. I hope you found at least one useful. At the end of the day it is the little things that you do that make a big difference in life, and in accumulating wealth.

Is there another personal financial topic you would like to learn more about? Comment below or send your inquiries to stashadvisor@gmail.com. We are all about bringing you the most value!

This blog post is provided for discussion purposes, and is not intended as professional financial advice. It’s intent is not to be used as the sole basis for your investment or tax planning decisions. To get more information please speak with a financial planner. Under no circumstances does this information represent a recommendation to buy or sell securities.