Being in your twenties can be tough. One second you are in college, partying, enjoying life, and the next you’re juggling a job, new responsibilities, and figuring out what you want to do for the rest of your life. Because of all this juggling it can be very easy to neglect your finances and make mistakes because your mind is on other things. We have compiled a list of financial mistakes adults in their twenties often make so you can be ahead of the curve.

Not Making a Budget or Sticking to it

A major pitfall that many face in their twenties is not having a budget. A budget is crucial because it helps you check in with yourself everyday to make sure you’re meeting your financial goals. Without a budget you are basically a ship without a steer, going wherever your emotions blow you. On the other hand, even when some make a budget, they find it very hard to stick to that budget. It is understandable that it can be hard to stick to a budget sometimes but it is crucial that you make the effort to do so because it is the difference between wealth and being perpetual broke. To learn some tricks to staying on budget, check out our post on 3 Easy Budgeting Tips.

Failure to Negotiate Their Salary

Another mistake that people in there twenties make is not negotiating their salary with employers. Out of the many ways to make money this is one of the quickest and simplest ways to increase your income. Many often overlook this strategy for various reasons for example they are scared that they may get their offered rescinded, or they just don’t know how to ask. Consider this, if your potential employer valued your talent wouldn’t they want to try and keep you, and second, the worst they could say to you is no. The bottom line is negotiating your salary is the very definition of nothing to lose and everything to gain. Do some quick Google searches or use sites like Glassdoor to learn the average salaries for your field and level of position.

Relying on Credit Cards

Irresponsible use of a credit card can be a fatal move. Using them can be very seductive because it often feels like you’re not spending your own money. On top of that, you don’t have to pay off your credit card immediately. This gets many into the habit of deferring payments. Before you know it, you’ve dug yourself into a deep hole of debt, and you have no idea how to get out. To avoid this, it is always wise to do your research on the credit cards you use, and to pay on time and in full. If you happen to already be in the hole check out our post on 5 Ways to Eliminate Your Debt.

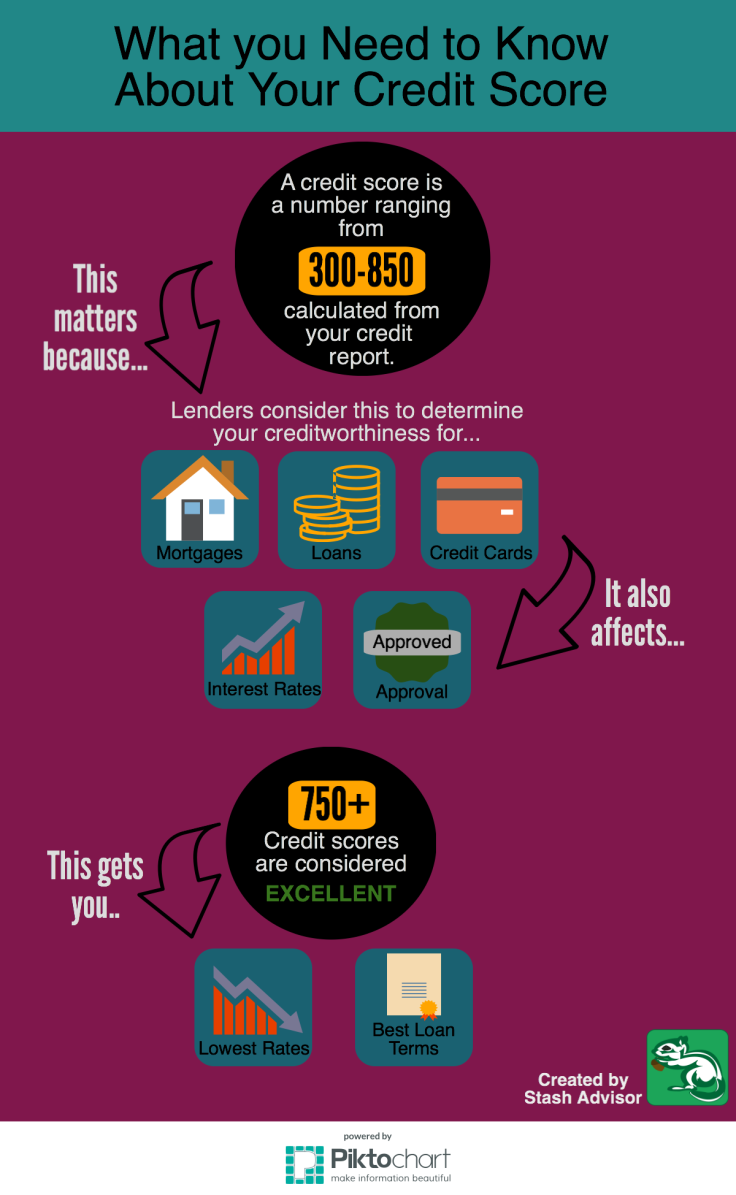

Neglecting Your Credit Score

Your credit score shows you and others how responsible you’ve been with the money you’ve borrowed over time, this includes not only loans but credit card history as well. A credit score ranges between 301 and 850. The higher the score the better your credit is considered. Your credit score is important because this score is taken into account when you want to make big purchases later on in life such as taking out a loan, buying a car, applying for a mortgage etc. It would be a huge mistake in your twenties to not know how credit scores work and not to build yours up, because it could restrict you from financial moves in the future.

Not Having an Emergency Savings Fund

As we all know life is very unpredictable, however it is safe to say that during your life there will be random unfortunate events that you can’t control. An emergency savings fund is protection between you and the random things in life. However, not many people in their twenties have this emergency buffer. Saving as little as $1,000 could save your finances on a rainy day. Check out our earlier blog on The Importance of Savings, and How to Start to learn more about getting started.

Neglecting to Invest Early

The idea of investing can seem complicated, which is why it’s understandable as to why a lot of people in their twenties don’t choose to invest. Not to mention that we have seen and heard about all sorts of things happening to the stock market. However, investing your money is one of the best ways to make your money work for you. Not to mention if you do your research and invest wisely you could find yourself not having to worry too much about your financial future regardless of what happens to you.

Waiting too Long to Save for Retirement

The biggest mistakes that people in their twenties make is not having a retirement strategy. This is an extremely easy thing to do because the idea of retirement seems to be light years away. Another easy trap to fall into is the notion that you can easily make up for lost time not spent saving for retirement. In reality it is actually the opposite, check out our post on How Much Money Do You Really Need for Retirement? to put things into perspective. The earlier you start saving the sooner you can put compound interest into play making it easier and easier to prepare for retirement as you get older.

In your twenties there are many different things that are calling for your attention. This makes it very easy to neglect things that are not very present in your life. This can result in making a few mistakes that can haunt you for years to come. Hopefully by reading this list you can catch yourself or avoid making the above mistakes all together.

Got a great idea or suggestion of what you would like us to blog about? Please send your inquiries to stashadvisor@gmail.com. We are all about bringing you the most value!

This blog post is provided for discussion purposes, and is not intended as professional financial advice. It’s intent is not to be used as the sole basis for your investment or tax planning decisions. To get more information please speak with a financial planner. Under no circumstances does this information represent a recommendation to buy or sell securities.