At one point in your life you have probably heard about stocks. whether you were watching the news, listening to the radio, working at your job, or talking with friends. You hear things like “The stock market is looking good!” or “The stock market crashed!” But what does it all mean? What is a stock? Maybe the most you’ve heard is don’t buy stocks because it’s too risky. But rather than turning away from something that could help you become financially free because it is confusing why not learn more about it. I would like to explain the basics of what a stock is so you can gain a basic understanding of it. This is important because no matter what happens in your life, if you would like to be financially free, you will at one point or another buy a stock. So then, what is a stock?

What are Stocks?

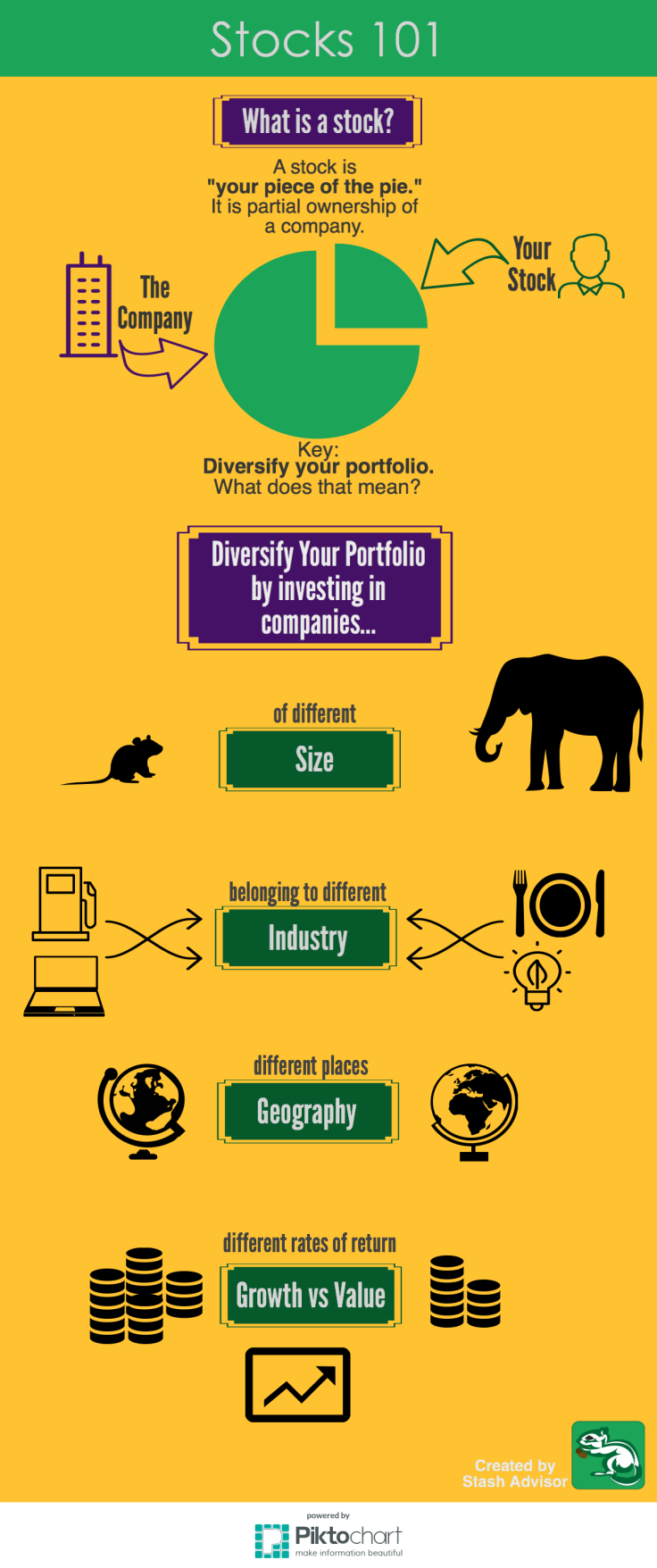

A stock, also known as shares or equity, is an item that represents partial ownership of a company’s assets and earnings. This means that if you purchase a company’s stock, you are considered to be a partial owner of the company. The more stocks of a company you own, technically, the more of the company you own. Think of a company as a pie with 8 pieces, and each piece of the pie represents a stock in the company. If you own four pieces, you own half of the company. Now that’s all well and good but why would a company sell stocks?

Why do Companies Sell Stocks?

A company sells stocks because they want to raise money for activities and projects to grow their company. Consider this example video What Are Stocks? from Investopedia. In the video you meet Steve. Steve is opening a pie company. He needs $100,000 but doesn’t want to borrow the funds from a bank. Instead, Steve invests $10,000 of his own money and finds 9 other investors who are willing to each invest $10,000. In return he give each investor a certificate that represents 10% of his pie company, each certificate represents 10% of the company’s assets (e.g. the building, the pie pans, and the backing material, and 10% of any future earnings). Because of this, Steve has raised enough money to implement his projects.

Why do you Want to Own Stocks?

You may be asking what’s in it for me if I am pay money to own stocks? Well remember how you own the assets and earnings of a company? If a company does well, their business will grow which means that their ventures will become larger. As a result, their value increases, which means that your original investment in the company will grow. Because of this increase, you can sell your share of the company for a profit. Let’s go back to investopedia’s example. After a year, Steve’s pie company is doing well and the company’s total value increases to $200,000 this means that each share of the company is now worth $20,000. The original investors can sell their stock in the company to other investors for a $10,000 profit.

The Risk in Owning Stocks

While the up side to stocks is that it’s value can increase, you should also know that it has a downside. If a company’s venture doesn’t go well or something happens to the company’s value, it’s value will go down which means that if you sell your stock it will be worth less than what you originally paid. For example, I’m sure in 2015 you heard about the e. coli scare for Chipotle. Prior to this, Chipotle’s stock did nothing but increase. At it’s height it’s stock price was over $700 per share! Once the news of it’s e. coli scare broke out, it’s stock gradually fell to the $400’s in early 2016. Such is the risks of owning stocks. There is however a way to reduce the risk of own stocks. This is called diversifying your portfolio.

Diversification and Types of Stock

First of all what is a portfolio? A portfolio is just the collection of stocks that you own. Diversifying your portfolio is when you own a different range of stocks. This is key to success in the stock market because not all stocks are the same, therefore they do not all perform the same. For example, if you have $170 to invest and you purchase type A of a stock at $100 a share and type B at $70 a share; then type A decreased to $90 a share, and type B increased to $110 a share you still made a profit of $30 ($100-$90=$10 lost for stock A, $110-$70=$40 gained from stock B, balancing out to $30 in profit because $40 profit -$10 lost = $30). There are many different types of stocks but I’ll just tell you about five basics ones:

Size:

A company’s size is measured by their current stock price multiplied by the number of share it has. This is called its market capitalization. Based on how big the company is, it is divided into three different categories. These are “large-cap”, “mid-cap”, and “small-cap”. The larger the capitalization the more stable the growth of a stock will be. For example it is less likely for a company like Microsoft to make big jumps in it’s share price in relation to a new company that might have a lot of growth potential.

Industry:

Stocks can belong to many different types of industries or sectors. These industries include retail, technology, food, infrastructure, energy, and many more.

Geography:

Stocks are not only contained to U.S., companies overseas also offer shares in their company. Purchasing stocks overseas can offer a great opportunity to increase your chances of an increased return on your investment as other countries might have larger developing markets.

Growth vs Value:

Stocks can generally be classified as a growth or value stock. Value stocks can be described as have a low price. They tend to belong to bigger, established companies. Value stocks are normally purchased because the purchaser believes that the stock’s price is less than what it will be worth in the future. In other words it’s a bargain.

Growth stocks are generally smaller, new companies, in fast growing industries. Their price also tends to move up and down a lot more than value stocks. Growth stocks are purchased because the purchaser believes that a company’s earnings will grow significantly in the future.

Index Funds

Essentially an index fund is an investment fund that tries to imitate the performance of a group of stocks or investment type. Instead of purchasing different types of individual stocks, you invest in an index fund which reduces the risk of the amount of money you lose because it follows the ebb and flow of the whole stock market rather depending on the performance of one company. For example, you could have an index fund that contains stocks in many different industries such as technology, retail, restaurants, etc. because of this the price of it’s stock is more likely to rise steadily because it’s averaging the price of each of those different industries. One of the most popular indexes is the Standard & Poor’s 500 Index (S&P 500) which is an index of 500 stocks chosen for market capitalization, industry, and other factors. However, there is one caveat to owning a stock index instead of an individual stock. Because you are owning the average of multiple different stocks, it is much less likely to grow faster than an individual stock. But, the less you risk the less you will be rewarded.

Stocks, can often be seen as a mystical subject that people don’t understand. As a result you may want to avoid them. However, I hoped by at least learning the basics of what a stock is, I have demystified stocks a little bit for you. Learning, about stocks, and eventually investing in stocks is one of the easiest, and most rewarding investment moves that you can make to increase your wealth!

Is there another personal financial topic you would like to learn more about? Comment below or send your inquiries to stashadvisor@gmail.com. We are all about bringing you the most value!

This blog post is provided for discussion purposes, and is not intended as professional financial advice. It’s intent is not to be used as the sole basis for your investment or tax planning decisions. To get more information please speak with a financial planner. Under no circumstances does this information represent a recommendation to buy or sell securities.